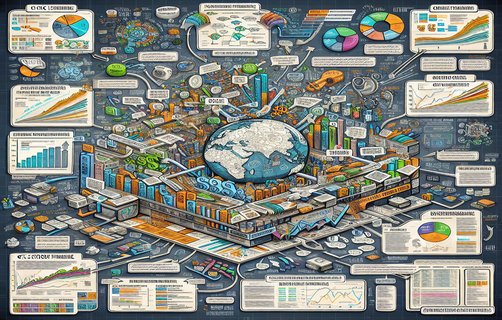

杠杆与配资:在金融市场的旋涡中,谁能更好地掌握风险与收益?

在 your next investment round, do you want to borrow ahead of the market or stand on the sidelines, watching others amuse themselves while cavorting with stocks? It’s amazing how many options we have nowadays in the finance world. Items like levered investments and financial partnerships (branded split-style) have never sounded more complex, yet they can lay the groundwork for potentially massive returns—or catastrophic losses. Think of leveraging investments as riding a surfboard on the mountainous waves of the stock markets. You have to know how to balance. It’s easy to be dazzled by the waves but knowing when to cut your losses is even more important.

To understand this better, let’s get into the distinctions. While 配资 (financing) allows you to amplify your capital with external resources, 杠杆炒股 (leveraged trading) engages the same premise but often feels more like borrowing from your future, banking a trench on value potential. Everyone simply wants to unleash the double-edged sword of investment: Higher stakes, higher acidity, accident-prone along with rewards. Each product comes with terms, risks, and regulations unique to our Asian markets.

As we dig deeper, one can confuse both types as shadow siblings within the volatile backdrop of financial expansion. Every day, opportunities swell in the global market, fueled by unpredictable currents. Statistically, platforms engaging in 配资 have multiplied over the past decade, evidenced by increasing statistics. According to the China Securities Regulatory Commission, the A-stock market capitalization celebrated a rise from 24% in 2020 to about 62% in 2023, indicating more financially leveraged operations at larger scales.

Choosing a solid配资平台 (financing platform) comes with essential due diligence. The rabbit hole curls further as you consider regulations, customer reviews, redemption terms, and hidden corner print appointments. Bloomberg revised its standards to classify leading investment by segmentation ratings, suggesting proactive updates on interface usability along with safe customer measures.

So, how do you actually application for financing? You line up with a valid trading account, followed by detailed inquiries regarding your credit and risk-bearing capabilities. Funding limits presented by your trading balance parallel an upward curve with high potential. Therefore, measured amounts can whip a multiplier of 40%, contradicting the benefits foreseen of bigger gains versus small losses seen straight past the mountain resolutions in today’s environment. With knowledge presented, one can start reaping inside dividends, riding overwhelmingly on the projected pipeline’s light that predicts future growth.

But here's the trick, the catch. Every tectonic shift coupled with leverage results in reflection and deep adjustment about the layer held resident long enough to diminish returns over probation increments. There seems to be golden opportunities cut into your paths if you label your situation capable elements unresolved beneath the pits of risk.

So, how about you? Do you plan to team with foes of uncertainty before facing off enemy markets? Is the thrill of using 配资 your next innovative investment diamond? What do you think your risk tolerance is within investments? Can you usher greater exploitation of undercurrent dated processes before keying indicators fall downward?

评论

GraceLee

这篇分析真的是非常深入,让我对杠杆炒股有了更全面的理解!

MarkJohnson

很有趣的文章,尤其是关于配资平台选择的部分。感谢分享!

小华

条理清晰、信息丰富,非常喜欢这样的内容!

SophieTang

文章用很通俗的方式介绍了复杂的金融概念,赞!

SamTaylor

作为投资小白,我觉得写得很好,值得一读,尤其是申请步骤那块。